After a fascinating run up in the Nifty in the last two days, it sure had some breath catching to do. Markets are half human, which means that if we get exhausted after a brisk run, so do the markets. And the run up seen in the last two days was much more than what we can call a ‘brisk run’. So, obviously, the markets needed some rest and they got it today. The Nifty managed to go about 50 points up in the first 30 minutes of the day and made a high of 4303 (as compared to my analysis yesterday that it had resistance at 4300). Soon enough, it started coming down and finally ended the day with a loss of 22 points while the BSE Sensex closed 47 points down. As of now, European markets closed in the red with prices paring upto 1.5% while the Dow Jones is more than 2% down. Crude has shot up to almost $128, a jump of $25 in a day. So, all international cues, at the time of writing this post, are negative.

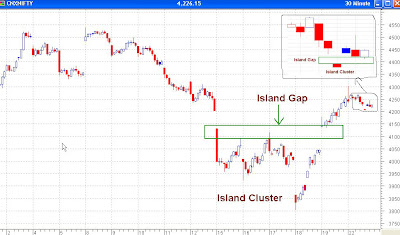

Seen above is the 30 minutes chart of the Nifty. We shall discuss island reversal techniques here. The Nifty on Monday last (15th Sep 2008) opened with a huge negative gap when Delhi was rocked by serial bomb blasts on Saturday, 13th Sep 2008, and Lehman Brothers in the USA declared bankruptcy. Three days later, on 18th Sep 2008, the markets opened with another big downward gap but soon recovered and the very next day it opened with a big positive gap after the US government bailed out insurance giant AIG by granting them a loan of $85 billion in return for 80% stake in the company. These gaps created a pattern known as an island reversal pattern. In such a pattern the prices open with a downward/upward gap, trade in a narrow range for sometime, and then open with another gap on the opposite side thus creating a candle or a cluster of candles to be separated from the rest of the candles. A cluster at the bottom is a bullish sign while a cluster on the top is a bearish sign. It is usually said that in case of an island reversal, chances are reasonably high that prices would return to the point from where the previous trend started. In this case the last downtrend started from 4540, so the charts suggest a rally to that level. More on island reversals can be read on Bedford and Associates and Incredible Charts. There are lot of other sites with information on island reversals. The chart above has today’s price candles inside a square which has been zoomed into and that shows another candle today which is separated from the rest of the prices, another short term bullish sign. Needless to say that an island cluster holds more significance and is more reliable than a single candle formed as an island.

Seen above is the 30 minutes chart of the Nifty. We shall discuss island reversal techniques here. The Nifty on Monday last (15th Sep 2008) opened with a huge negative gap when Delhi was rocked by serial bomb blasts on Saturday, 13th Sep 2008, and Lehman Brothers in the USA declared bankruptcy. Three days later, on 18th Sep 2008, the markets opened with another big downward gap but soon recovered and the very next day it opened with a big positive gap after the US government bailed out insurance giant AIG by granting them a loan of $85 billion in return for 80% stake in the company. These gaps created a pattern known as an island reversal pattern. In such a pattern the prices open with a downward/upward gap, trade in a narrow range for sometime, and then open with another gap on the opposite side thus creating a candle or a cluster of candles to be separated from the rest of the candles. A cluster at the bottom is a bullish sign while a cluster on the top is a bearish sign. It is usually said that in case of an island reversal, chances are reasonably high that prices would return to the point from where the previous trend started. In this case the last downtrend started from 4540, so the charts suggest a rally to that level. More on island reversals can be read on Bedford and Associates and Incredible Charts. There are lot of other sites with information on island reversals. The chart above has today’s price candles inside a square which has been zoomed into and that shows another candle today which is separated from the rest of the prices, another short term bullish sign. Needless to say that an island cluster holds more significance and is more reliable than a single candle formed as an island. Seen above is the same 30 minutes chart of Nifty but with another set of information. We are trying to use some Fibonacci rules on this chart. The prices started coming down from a high of 4538 on 8th Sep 2008 and touched a low of 3800 on 18th Sep 2008. Then the trend reversed and the prices rallied and retraced almost 61.8% in a matter of two days as shown by the Fibonacci retracement levels in dark green and in large brown numbers. A small rest is being taken by the Nifty currently. There are two possibilities. If we are in a bear market, we could see all these gains wiped out and should see prices coming below 3800. But if we are in a bull market then the most reasonable ‘rest’ that we can expect is a retracement of 23.6% or 38.2% of the rise seen in the last two days. As seen by the Fibonacci retracement levels in light green, a 23.6% retracement should see prices down to 4190 levels while a 38.2% retracement would bring us down to 4115. As already mentioned, international cues are all negative at the moment.

Seen above is the same 30 minutes chart of Nifty but with another set of information. We are trying to use some Fibonacci rules on this chart. The prices started coming down from a high of 4538 on 8th Sep 2008 and touched a low of 3800 on 18th Sep 2008. Then the trend reversed and the prices rallied and retraced almost 61.8% in a matter of two days as shown by the Fibonacci retracement levels in dark green and in large brown numbers. A small rest is being taken by the Nifty currently. There are two possibilities. If we are in a bear market, we could see all these gains wiped out and should see prices coming below 3800. But if we are in a bull market then the most reasonable ‘rest’ that we can expect is a retracement of 23.6% or 38.2% of the rise seen in the last two days. As seen by the Fibonacci retracement levels in light green, a 23.6% retracement should see prices down to 4190 levels while a 38.2% retracement would bring us down to 4115. As already mentioned, international cues are all negative at the moment.Please do subscribe to my posts, so that all posts are delivered free to your inbox and you don't miss any useful analysis of the markets in the future.

Happy Investing!!!

No comments:

Post a Comment