The Nifty on Friday managed to make another doji candle. That makes it three consecutive dojis, each candle having a lower high and a lower low. Interestingly, each day was a green day, meaning that the Nifty closed with gains on each of these three days. The Nifty ended with 14 points of gains on Wednesday, 6 points on Thursday and 5 points on Friday. A doji suggests indecisiveness and technically signals that the market is taking some rest before starting another big move, which could be up or down. But after a long rally or a long decline, the formation of a doji may signal a reversal in the trend.

In this particular case, a doji was formed after a rally of 800 points from the lows. And we have seen three consecutive dojis since then. This should have signaled the beginning of a downtrend. The fact that it has not means that more analysis needs to go into this. Let us look at the details and the circumstances under which the doji was formed. The short term trend has been for quite some time now. On the daily charts, we have seen a pattern of higher highs and higher lows, which again suggests bullishness and which means we are in an intermediate term uptrend too. On the daily charts, a bullish head and shoulders pattern was formed and a candle going through the neckline should have been a large range candle with good volumes but that turned out to be a doji. On the weekly charts, we are seeing a pattern of lower highs and lower lows, which means we are in a long term downtrend. And it will remain so till we have a pivot low higher than 3800 or if the prices were to go above 5300.

This means that we are in a short term uptrend, an intermediate uptrend but in a primary downtrend. We would expect the market to follow the longer term trend, which remains down. But that does not stop the market from following the short term and intermediate trend before following the primary trend. In such a situation it is best to follow the short term trend. Short term trends can be seen on the 30 minutes or 60 minutes charts. Attached below is the 60 minutes chart of the Nifty from the lows made on 16th July till date. Initially, we saw a big rally and then a corrective period before the rise started again.

Since the last three days the Nifty has been moving within a narrow range trend channel, as seen on this 60 minutes chart. As can be seen, this is a falling trend channel or a channel sloping downwards. The significance of a falling trend channel or a falling wedge after a long rally is exactly the opposite of the significance of a doji after a long rally. While a doji after a long rally holds negative implications, a falling channel or a falling wedge after a rally is a bullish sign. Another important thing present on the chart is a trendline connecting the lows formed on 16th July, 29th July, 1st August and Friday’s lows. This trendline shows that the Nifty is now at support and may not go down further. The trend channel shows that resistance is at 4550 and should not go above that. But Nifty cannot remain in this 50 point range forever. A trending move should now come about which would take the Nifty above 4550 or bring it below the lower end of the trend channel at 4450. We shall take a position depending on which side the Nifty breaks out on. For now, it is just wait and watch.

Since the last three days the Nifty has been moving within a narrow range trend channel, as seen on this 60 minutes chart. As can be seen, this is a falling trend channel or a channel sloping downwards. The significance of a falling trend channel or a falling wedge after a long rally is exactly the opposite of the significance of a doji after a long rally. While a doji after a long rally holds negative implications, a falling channel or a falling wedge after a rally is a bullish sign. Another important thing present on the chart is a trendline connecting the lows formed on 16th July, 29th July, 1st August and Friday’s lows. This trendline shows that the Nifty is now at support and may not go down further. The trend channel shows that resistance is at 4550 and should not go above that. But Nifty cannot remain in this 50 point range forever. A trending move should now come about which would take the Nifty above 4550 or bring it below the lower end of the trend channel at 4450. We shall take a position depending on which side the Nifty breaks out on. For now, it is just wait and watch.

Please do subscribe to my posts, so that all posts are delivered free to your inbox and you don't miss any useful analysis of the markets in the future.

Happy Investing!!!

Read the Full Post Here

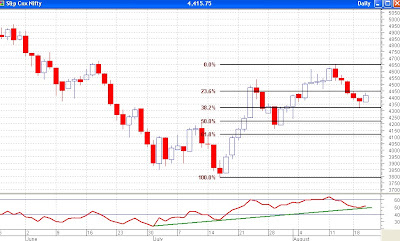

Seen above is the daily chart of the Nifty along with the Relative Strength Index (RSI). As seen in the chart above, the RSI has found support at 40 at the same time as the Nifty found support near the lower end of the trend channel at 4200. This seems to be a short term bullish for the markets and as mentioned in Thursday’s post, the outlook for the future remains the same since the Nifty is still locked between the range of 4200-4650. In short, in the very short term further downside may have been avoided for now but from a short to a medium term perspective, the trend remains sideways. A clear direction would be known only after one of these ranges. For now, we shall wait for the Nifty to reach 4650, or for the point where there is a return line failure. A failure to reach either the top or the bottom of a trend channel is known as a return line failure.

Seen above is the daily chart of the Nifty along with the Relative Strength Index (RSI). As seen in the chart above, the RSI has found support at 40 at the same time as the Nifty found support near the lower end of the trend channel at 4200. This seems to be a short term bullish for the markets and as mentioned in Thursday’s post, the outlook for the future remains the same since the Nifty is still locked between the range of 4200-4650. In short, in the very short term further downside may have been avoided for now but from a short to a medium term perspective, the trend remains sideways. A clear direction would be known only after one of these ranges. For now, we shall wait for the Nifty to reach 4650, or for the point where there is a return line failure. A failure to reach either the top or the bottom of a trend channel is known as a return line failure.