Click on the charts below to view a larger picture. The Nifty yesterday went below our support of 6150 and ended the day quite close to our support line of 6060. There was no newsletter yesterday otherwise the next supports of 6050 and 5980 (marked as trendline B) would have been given. The market, however, has its own mind and it quite convincingly broke through both the supports in the first 30 minutes itself. But it did find support at the next support line (marked as trendline C) at 5830 and reversed from there. The next support zone below 5830 is between 5700 and 5750. Below 5700, we could be in an intermediate downtrend, which would mean a much deeper correction. For tomorrow, the first support and first resistance levels are 5830 and 5970 respectively. A move above 5970 will bring us back to the same resistance levels of 6060 and 6130.

The Nifty yesterday went below our support of 6150 and ended the day quite close to our support line of 6060. There was no newsletter yesterday otherwise the next supports of 6050 and 5980 (marked as trendline B) would have been given. The market, however, has its own mind and it quite convincingly broke through both the supports in the first 30 minutes itself. But it did find support at the next support line (marked as trendline C) at 5830 and reversed from there. The next support zone below 5830 is between 5700 and 5750. Below 5700, we could be in an intermediate downtrend, which would mean a much deeper correction. For tomorrow, the first support and first resistance levels are 5830 and 5970 respectively. A move above 5970 will bring us back to the same resistance levels of 6060 and 6130.

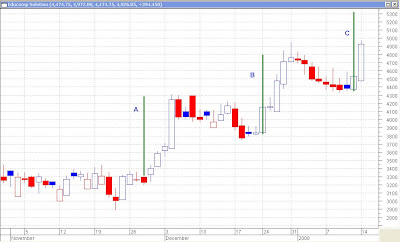

Aban Lloyd, on this daily chart, may have found support in this trading range between 4500 and 5400 and may go back to the top end of the range before long. RSI above 40 even after so much decline is a confidence booster. Aban did go down to a low of 4550 but soon recovered to close at 4790. One can consider buying near 4800 with a stop loss of 4500 and a target between 5250 and 5400 is possible.

Aban Lloyd, on this daily chart, may have found support in this trading range between 4500 and 5400 and may go back to the top end of the range before long. RSI above 40 even after so much decline is a confidence booster. Aban did go down to a low of 4550 but soon recovered to close at 4790. One can consider buying near 4800 with a stop loss of 4500 and a target between 5250 and 5400 is possible. On the daily charts, BEML (Bharat Earth Movers) may just have found support at this line. Not completely a risk free trade but the risk to reward ratio is quite low in this. One may consider buying it at around 1600 with a stop below 1550 and a target of 1800 seems achievable. Avoid buying/placing stop in the first half hour of the day. Let the initial euphoria/panic of the market die down.

On the daily charts, BEML (Bharat Earth Movers) may just have found support at this line. Not completely a risk free trade but the risk to reward ratio is quite low in this. One may consider buying it at around 1600 with a stop below 1550 and a target of 1800 seems achievable. Avoid buying/placing stop in the first half hour of the day. Let the initial euphoria/panic of the market die down. Bharat Heavy Electricals Ltd. (BHEL) was consolidating in a bearish triangle on its daily chart. This triangle seems to have been broken today. Not only that, a five month old trendline was also broken in the last week, which also suggested weakness. A breakdown from this triangle gives a target of 1900. In a bull market, downside targets may be difficult to achieve but BHEL surely is in a downtrend now. Close long positions. Stay away.

Larsen and Toubro has been inside a trading range (4000-4600) for quite some time now and inside a smaller trading range (4000-4400) for almost 2 months. With a stop loss below 3920, one can consider buying it near the current market price of 3980 for targets of 4400 and 4600.

Happy investing!!!

Aban Lloyd has made an inverted head and shoulders pattern and has now broken out of it giving us a target of 5800. While it has already gone up by about 300 rupees yesterday, yet another 400 seem to be in the offing. One can consider buying the stock near 5400 with a stop loss of 5050 and wait for a target of 5750-5800.

Aban Lloyd has made an inverted head and shoulders pattern and has now broken out of it giving us a target of 5800. While it has already gone up by about 300 rupees yesterday, yet another 400 seem to be in the offing. One can consider buying the stock near 5400 with a stop loss of 5050 and wait for a target of 5750-5800. Financial Technologies seems to have broken out of its downtrend. This is, probably, a good time to buy it from a short to medium term perspective (3-6 months). If things go well, it might give a return of 25-30% from current levels. Keep a stop loss of 2400 for the time being and as the price goes up keep a trailing stop loss.

Financial Technologies seems to have broken out of its downtrend. This is, probably, a good time to buy it from a short to medium term perspective (3-6 months). If things go well, it might give a return of 25-30% from current levels. Keep a stop loss of 2400 for the time being and as the price goes up keep a trailing stop loss. Praj Industries looks like it is going to move northwards from this point on. A target of 330 seems to be on the cards for this heavy engineering stock. Keep a stop loss of 235 for this purpose and put a trailing stop loss on any price increase.

Praj Industries looks like it is going to move northwards from this point on. A target of 330 seems to be on the cards for this heavy engineering stock. Keep a stop loss of 235 for this purpose and put a trailing stop loss on any price increase.  Reliance Communications, after yesterday's long blue candle, seems to be pushing against the resistance level. The RSI also has made an inverted head and shoulders pattern, which, if broken, will be bullish for the stock. The price chart itself suggests a target of 880 if it is able to cross 770 in a day or two. A stop loss of 700 should be safe, though, even 720 seems to be a support.

Reliance Communications, after yesterday's long blue candle, seems to be pushing against the resistance level. The RSI also has made an inverted head and shoulders pattern, which, if broken, will be bullish for the stock. The price chart itself suggests a target of 880 if it is able to cross 770 in a day or two. A stop loss of 700 should be safe, though, even 720 seems to be a support. This 30 minutes chart of Nifty shows that Nifty has broken out of the trading range of 6110-6160 today and closed just above the trading range. The black trendline suggests that the uptrend has been broken. But a break of the trendline does not necessarily mean a change of trend. It can mean either a change of trend or a slowing down of trend. In this case, it has meant a slowing down of trend because the red trendline is still intact. While the target for Nifty remains 6500, yet, minor corrections are expected along the way. Support now is at 6080 and below that at 6020. Expect some minor support around 6160 too.

This 30 minutes chart of Nifty shows that Nifty has broken out of the trading range of 6110-6160 today and closed just above the trading range. The black trendline suggests that the uptrend has been broken. But a break of the trendline does not necessarily mean a change of trend. It can mean either a change of trend or a slowing down of trend. In this case, it has meant a slowing down of trend because the red trendline is still intact. While the target for Nifty remains 6500, yet, minor corrections are expected along the way. Support now is at 6080 and below that at 6020. Expect some minor support around 6160 too.