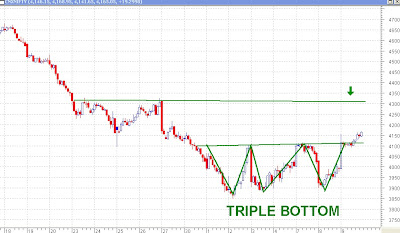

Attached above is the daily chart of Nifty. The Nifty, as can be clearly seen, has reversed after testing the top of the trend channel. This was expected since the 4180-4200 support is quite a strong support. Yesterday we did see the Nifty go down to a level of 4160 intraday but it closed at 4190. If we have another day of upmove tomorrow and if the prices were to go above 4350, we would have a pivot low in place at 4160. A pivot low formed at 4160 would mean that the Nifty has finally formed a pattern of higher highs and higher lows, which would bring the Nifty back in an uptrend. Back in an uptrend means, we should be buyers now and our stop loss for all long positions should be the most recent pivot low at 4160. But before we go on to buy, we should be aware of the different definitions of an uptrend. Technically, a stock (or an index) comes back in an uptrend when it goes up, comes back down to form a low (which is higher than the previous low) and then goes back up above its previous high. Quite often the prices first go on to make a higher high (like the Nifty displayed this time around) and then form a higher low. Here there are two schools of thought. One says that the uptrend has started, whereas the other school waits for the prices to go back above its previous high (in which case it makes it two higher highs and a higher low) before buying. Needless to say, the second school of thought has a much better chance of making a profit. And it is also understood that it is the first school which buys at a cheaper price and makes more profits if the signal turns out to be correct for them.

Attached above is the daily chart of Nifty. The Nifty, as can be clearly seen, has reversed after testing the top of the trend channel. This was expected since the 4180-4200 support is quite a strong support. Yesterday we did see the Nifty go down to a level of 4160 intraday but it closed at 4190. If we have another day of upmove tomorrow and if the prices were to go above 4350, we would have a pivot low in place at 4160. A pivot low formed at 4160 would mean that the Nifty has finally formed a pattern of higher highs and higher lows, which would bring the Nifty back in an uptrend. Back in an uptrend means, we should be buyers now and our stop loss for all long positions should be the most recent pivot low at 4160. But before we go on to buy, we should be aware of the different definitions of an uptrend. Technically, a stock (or an index) comes back in an uptrend when it goes up, comes back down to form a low (which is higher than the previous low) and then goes back up above its previous high. Quite often the prices first go on to make a higher high (like the Nifty displayed this time around) and then form a higher low. Here there are two schools of thought. One says that the uptrend has started, whereas the other school waits for the prices to go back above its previous high (in which case it makes it two higher highs and a higher low) before buying. Needless to say, the second school of thought has a much better chance of making a profit. And it is also understood that it is the first school which buys at a cheaper price and makes more profits if the signal turns out to be correct for them.I would normally side with the first school rather than the second but it all depends on the situation. At present, if the Nifty were to go above 4350 tomorrow, there is resistance close by near 4480 (this level will keep reducing every passing day) as suggested by the trendline. What if the Nifty were to reverse from this level? I’ll be making a profit of only 100 odd points, which is not much. Also, there is likelihood that the candlestick pattern formed here is that of ‘three black crows’, which gives a very negative outlook to the Nifty. Had the small narrow range blue candle, formed on Monday, not been there, this would have been a classic ‘three black crows’ pattern, which happens to be a reversal pattern. It is the presence of this blue candle that creates doubts. The ‘three black crows’ candlestick pattern usually follows a period of strong advance and within this pattern three black(in our case, red) candles/shaded candles are formed with non-existent or small lower shadows. These three candles have lower highs and lower lows. Usually, the fourth candle is a white/blue/unshaded candle but could also be a black/red candle. The fifth or the sixth candle, generally, takes the prices below the low of the ‘third crow’. If this does turn out to be a ‘three black crows’ pattern (ignoring the blue candle formed inbetween the crows) and the low of 4160 is broken in the next one or two days, we could be looking at a retest/breakthrough of the 3800 lows too. For now, I would much rather stay with the second school of thought and buy only if the Nifty were to go above its previous high of 4540.

Please do subscribe to my posts, so that all posts are delivered free to your inbox and you don't miss any useful analysis of the markets in the future.

Happy Investing!!!

Read the Full Post Here