The Nifty opened with a huge positive bias because of all the positives visible in the Indian political situation and the global markets, as were mentioned in yesterday’s post. The Nifty jumped up about 130 points in the first five minutes of trade and about 160 points up in the first fifteen minutes. Things then cooled down a bit and the Nifty came back within the range discussed in yesterday’s post. It was only in the mid-afternoon when the European markets also opened positive that the Nifty broke through the trading range and went on to make new highs for the day.

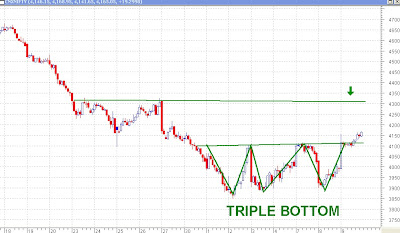

Above is the 30 minutes chart of the Nifty and shows that a triple bottom has been made over the period of the last 10 days. This is the first time in the 8 months history of this blog that the Nifty has made a triple bottom. The blog has seen lots of double bottoms and double tops but never a triple bottom. A triple bottom is a reversal pattern, as are the head and shoulders, double tops and bottoms and triple tops. A reversal pattern means those patterns that are generally found towards the end of trends. This triple top being confirmed may well show that the downtrend of the Nifty has now finished, at least in the short term. We are now in a well defined short term uptrend, the target for which is at least 4300. It may find resistance near the trendline marked by the arrow which lies between 4310 and 4320. A move above that trendline may turn out to be good for the markets.

Above is the 30 minutes chart of the Nifty and shows that a triple bottom has been made over the period of the last 10 days. This is the first time in the 8 months history of this blog that the Nifty has made a triple bottom. The blog has seen lots of double bottoms and double tops but never a triple bottom. A triple bottom is a reversal pattern, as are the head and shoulders, double tops and bottoms and triple tops. A reversal pattern means those patterns that are generally found towards the end of trends. This triple top being confirmed may well show that the downtrend of the Nifty has now finished, at least in the short term. We are now in a well defined short term uptrend, the target for which is at least 4300. It may find resistance near the trendline marked by the arrow which lies between 4310 and 4320. A move above that trendline may turn out to be good for the markets.What is the future of the markets? Have the markets made a temporary bottom or a major bottom? Is there any more pain left in the markets? Here is a video which gives both sides of the story. You pick which side you want to believe. I, personally, agree with Surjit Bhalla of O(x)us Invt and fully agree with him that markets do tend to bottom out 6 months before the economy does. And I’m pretty sure that the fundamental situation and economies of the world will be showing a much better picture than what has been painted today.

So, what do we do? I feel there is no point trying to predict whether the markets will go down or go up. We should just follow the trend. We buy now in the short term because the short term trend is now up. We should buy with a medium term time frame when the intermediate term changes to up. No attempt should be made to predict the markets because that brings a bias in our trading decisions. We let the markets decide what it wants to do because markets have a mind of their own, a brain of their own.

On a lighter note, like all of us, the market’s brain is divided into two sides – a left side and a right side. Unfortunately, the left side has nothing right in it while the right side has nothing left in it.

Please do subscribe to my posts, so that all posts are delivered free to your inbox and you don't miss any useful analysis of the markets in the future.

Happy Investing!!!

No comments:

Post a Comment