The Nifty recovered today, as we had been expecting in the last two days. The signals were quite evident as there were multiple supports available between 4330 and 4380, as was mentioned in the post titled “Multiple Supports for Nifty Between 4330 and 4380”. While writing the newsletter last night, the global situation was bad but the Asian markets were good in the morning. The American markets today are flat while the European markets closed marginally in the green.

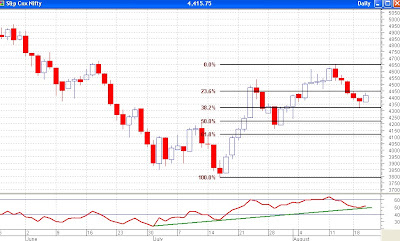

Pasted above is the daily chart of Nifty zoomed in to see the most recent data along with the Fibonacci retracement levels. The rally that started in the middle of last month and which continued till the middle of this month and which measured almost 800 points has retraced by 38.2% and exactly from those levels it turned back. Fibonacci retracement levels are very helpful to determine support and resistance levels for the markets.

Pasted above is the daily chart of Nifty zoomed in to see the most recent data along with the Fibonacci retracement levels. The rally that started in the middle of last month and which continued till the middle of this month and which measured almost 800 points has retraced by 38.2% and exactly from those levels it turned back. Fibonacci retracement levels are very helpful to determine support and resistance levels for the markets.Not shown on the chart, but which was part of my analysis today, was the retracement levels of the recent decline from 4650 to 4316 and I found that during the current rally the market would retrace 38.2% at 4450, 50% at 4485 and 61.8% at 4520. So, these are some of the resistance points for the markets. 4450, as can be seen on the chart above, also happens to be the 23.6% retracement level which again should provide resistance. That does not mean that it will find resistance and turn back at one of these levels, but it remains a possibility.

Mr. Sudarshan Sukhani, a noted Technical Analyst, in his blog post today mentions that the Nuclear Suppliers Group, which is to meet on Thursday, is likely to approve the India specific nuclear safeguards agreement. He feels that the current rally may be discounting that news in advance and he is expecting a euphoric surge once the news does come through. He advises his readers to book profits during that euphoria as the positive effects out of the deal will be seen 10 years from now and that it is just not worth an increase in the markets now. I somehow agree with his view. In any case, I expect the markets to remain range bound and the possibility of the markets crossing 4650 in this rally remain bleak. If the Nifty does manage to go above 4650 in this rally, I would be proved wrong by the markets one more time.

Please do subscribe to my posts, so that all posts are delivered free to your inbox and you don't miss any useful analysis of the markets in the future.

Happy Investing!!!

No comments:

Post a Comment